2025 Contribution Ira. This allows individuals of all income levels to contribute to a traditional ira and potentially benefit from tax deductions. The deadline to make a traditional ira contribution for the current tax year is typically april 15 of the following tax year.

This is an increase from 2025, when the limits were $6,500 and $7,500, respectively. The ira contribution limit does not apply to:

2025 Contribution Limits Announced by the IRS, The deadline to make a traditional ira contribution for the current tax year is typically april 15 of the following tax year. The ira catch up contribution limit for individuals aged 50 and over was changed to now include a cola under the secure 2.0 but remains $1,000 for 2025.

IRS Unveils Increased 2025 IRA Contribution Limits, Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older). The limit on annual contributions to an ira is increased to $7,000 for 2025, up from $6,500 in 2025.

2025 Ira Limits Over 50 Cori Joeann, If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000. Updated on february 14, 2025.

IRA Contribution Limits And Limits For 2025 And 2025, Learn about our editorial process. It may not be a good thing for heirs, experts say.

The IRS just announced the 2025 401(k) and IRA contribution limits, $7,000 if you're younger than age 50. A few other rules around.

2025 Simple Ira Contribution Ilise Leandra, Before the secure act of. The roth ira income limits are $161,000 for single tax filers and $240,000 for those married filing jointly.

401k 2025 Contribution Limit IRA 2025 Contribution Limit, This allows individuals of all income levels to contribute to a traditional ira and potentially benefit from tax deductions. A few other rules around.

2025 Simple Ira Contribution Ilise Leandra, For the year 2025, you may contribute: The irs has again waived required withdrawals for certain americans who have inherited retirement accounts since 2025.

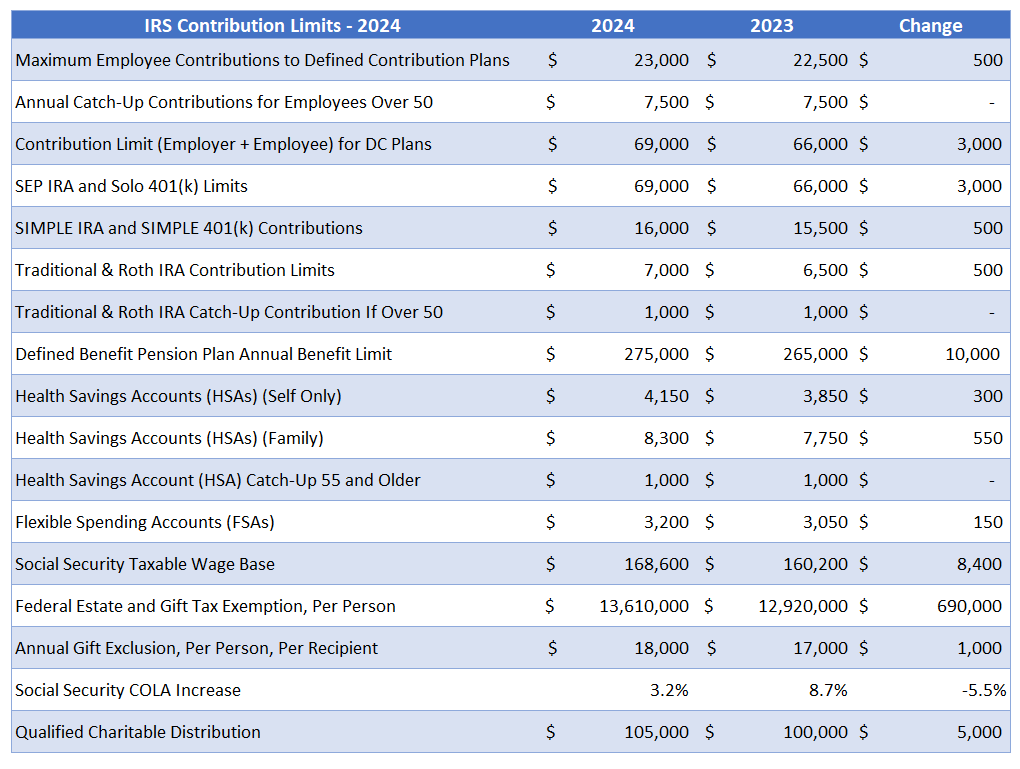

2025 IRS Contribution Limits For IRAs, 401(k)s, and More, For 2025, 2025, 2025 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can't be more than: $6,000 ($7,000 if you're age 50 or older), or.

Unlock Your Financial Future A Quick Guide to 2025's IRA and, For 2025, the ira contribution limit is $7,000 for those under 50, and $8,000 for those age 50 and older. $8,000 if you're aged 50 or older.