Federal Payroll Tax Tables 2025. Total revenue was $2.8 billion, an increase of 10% over the prior year. The effective tax rate for 2025 is 0.6%.

Percentage method tables for automated payroll systems and withholding on periodic payments of pensions and annuities. As of 2025, each pay 6.2% for social security and 1.45% for medicare.

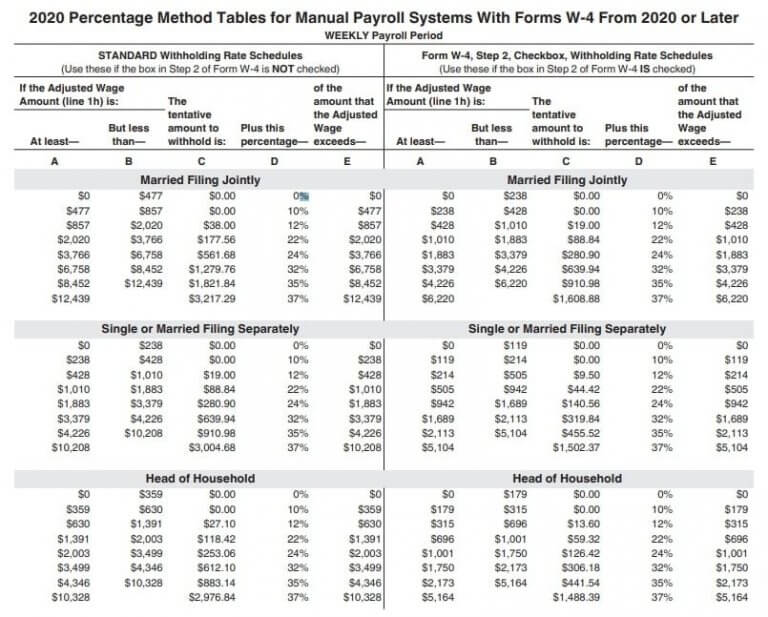

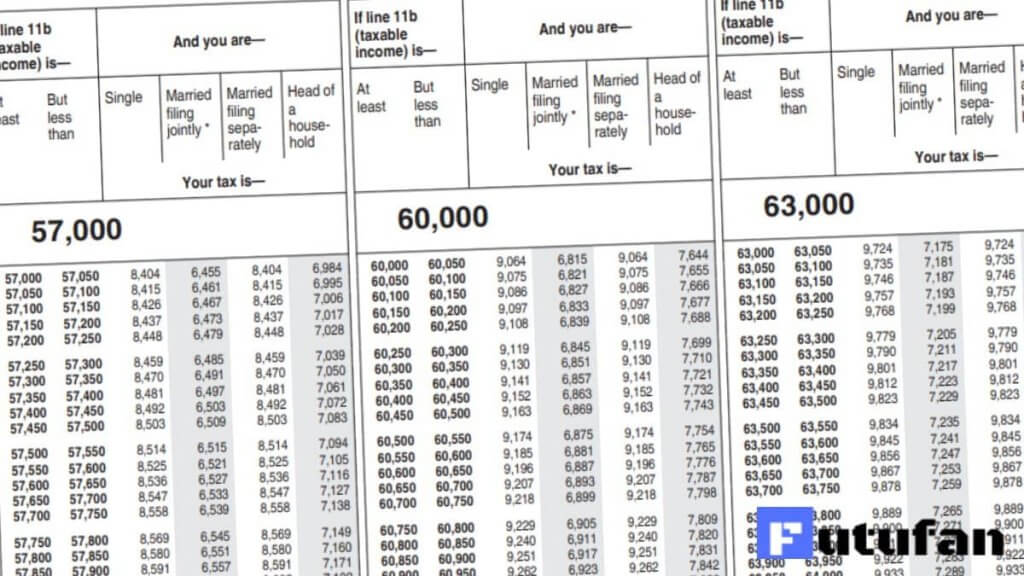

Federal Withholding Tables 2025 Federal Tax, If you're an employer with an automated payroll system, use worksheet 1a and the percentage method tables in this section to figure federal income tax withholding. The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an.

Maximize Your Paycheck Understanding FICA Tax in 2025, The 2025 tables for federal income tax withholding are now available, irs said during a recent payroll industry call. Social security and medicare tax for 2025.

Tax rates for the 2025 year of assessment Just One Lap, The effective tax rate for 2025 is 0.6%. Tables at the back of the budget show that the united states will likely lose $1.9 trillion in fiscal year 2025 on $5 trillion in revenue,.

IRS Tax Tables 2025 2025, If applicable, before processing payroll for tax year 2025, you. This tax rate is technically 6%, but federal credits automatically reduce it to 0.6% for employees in most states.

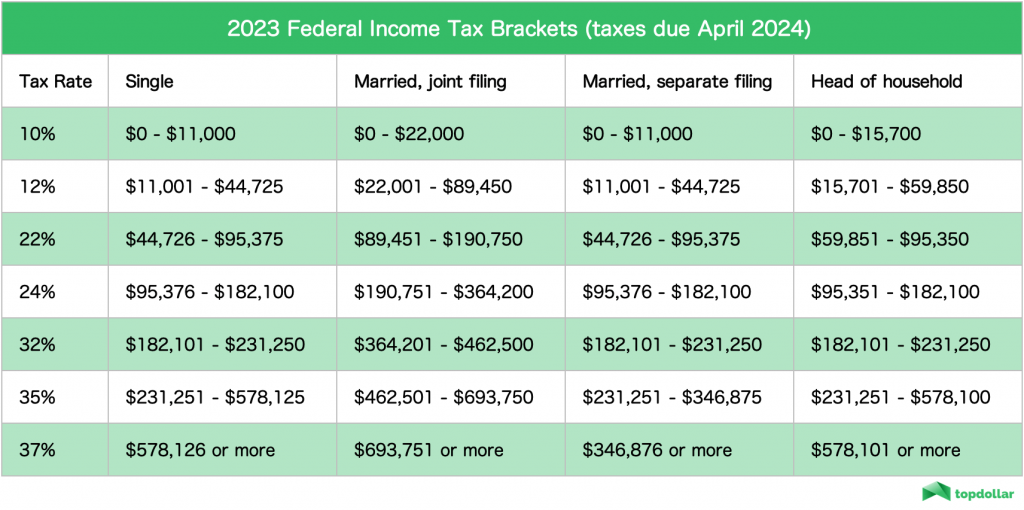

2025 Federal Tax Brackets Chart Dulci Glennie, Tax rates and income thresholds. Family and medical leave insurance (famli) employer liability tax rate (employer) note:

Tax Rates 2025 To 2025 2025 Printable Calendar, Family and medical leave insurance (famli) employer liability tax rate (employer) note: As of 2025, each pay 6.2% for social security and 1.45% for medicare.

Here are the federal tax brackets for 2025 vs. 2025, Total revenue was $2.8 billion, an increase of 10% over the prior year. The minimum standard deduction has increased from $1,700 to $1,800.

T130241 Distribution of Federal Payroll and Taxes by Expanded, The minimum standard deduction has increased from $1,700 to $1,800. Commissions do not affect our editors'.

Federal Tax Withholding Tables Weekly Payroll My Bios, Payroll deductions tables (t4032) who should use this guide? The federal standard deduction for a single filer in 2025 is $ 14,600.00.

Federal Payroll Tax Tables Elcho Table, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. The income tax withholding formula has changed effective january 1, 2025.

On the december 7 payroll industry call, the irs confirmed that the early release table data could be used to update payroll systems.